How To Open a Free Business Checking Account

New digital-age free online business checking accounts are a game-changer for small businesses. These accounts don’t just save you time and stress by letting you manage your finances online — they also make it easier than ever to open an account with many of your favorite banks.

These accounts are free, or almost free, because they come with strings attached. But that’s not necessarily a bad thing. The new breed of free business checking account have requirements — usually concerning eKYC verification, uploading personal documents, or taking another action within a specified period of time — to keep the user experience frictionless while still protecting the bank’s interests.

And we think that’s a great thing! Here are details on how to open a free business checking account from several leading financial institutions in one simple step:

What is eKYC?

eKYC — short for electronic know your customer — is a process that lets financial institutions accept digital documents that verify a customer’s identity. Once a bank accepts one of your documents through an eKYC process, it is added to a database that other banks can access. This means you can open new accounts more easily with other financial institutions, and you don’t have to send in copies of the same documents again and again.

8 Banks That Offer Free Online Business Checking Account

There are many banks that offer free business checking account. Some of the most popular include:

American Express : American Express charges no monthly fee and doesn’t require a minimum monthly balance. The account comes with a Business Platinum card and a $100 credit for travel expenses. Another great perk is that you get a $100 statement credit each time you add a new cardholder to your account.

American Express also offers eKYC through a feature called “Quick Add.” Quick Add saves time when adding new employees to your account by enabling you to collect their information digitally and submit it to the bank for verification.

BBVA : BBVA’s free checking account comes with no monthly maintenance fee, no minimum balance requirement, and free online and mobile banking. The account also provides free ATM fee reimbursement, free international transfers, and free bill pay. BBVA’s free business checking account has no annual fee and no minimum balance requirement.

Capital One : Capital One offers a free business checking account that comes with no monthly fee, no minimum balance requirement, free mobile banking, free online bill pay, and free CO2-endorsed carbon paper. You can also earn an unlimited 1% cash back when you use your debit card for purchases.

Charles Schwab : Schwab’s checking account has no monthly fee or minimum balance requirement. You can make free transfers to your linked Schwab One brokerage account, and you’ll also receive free online access to your account and free bill pay.

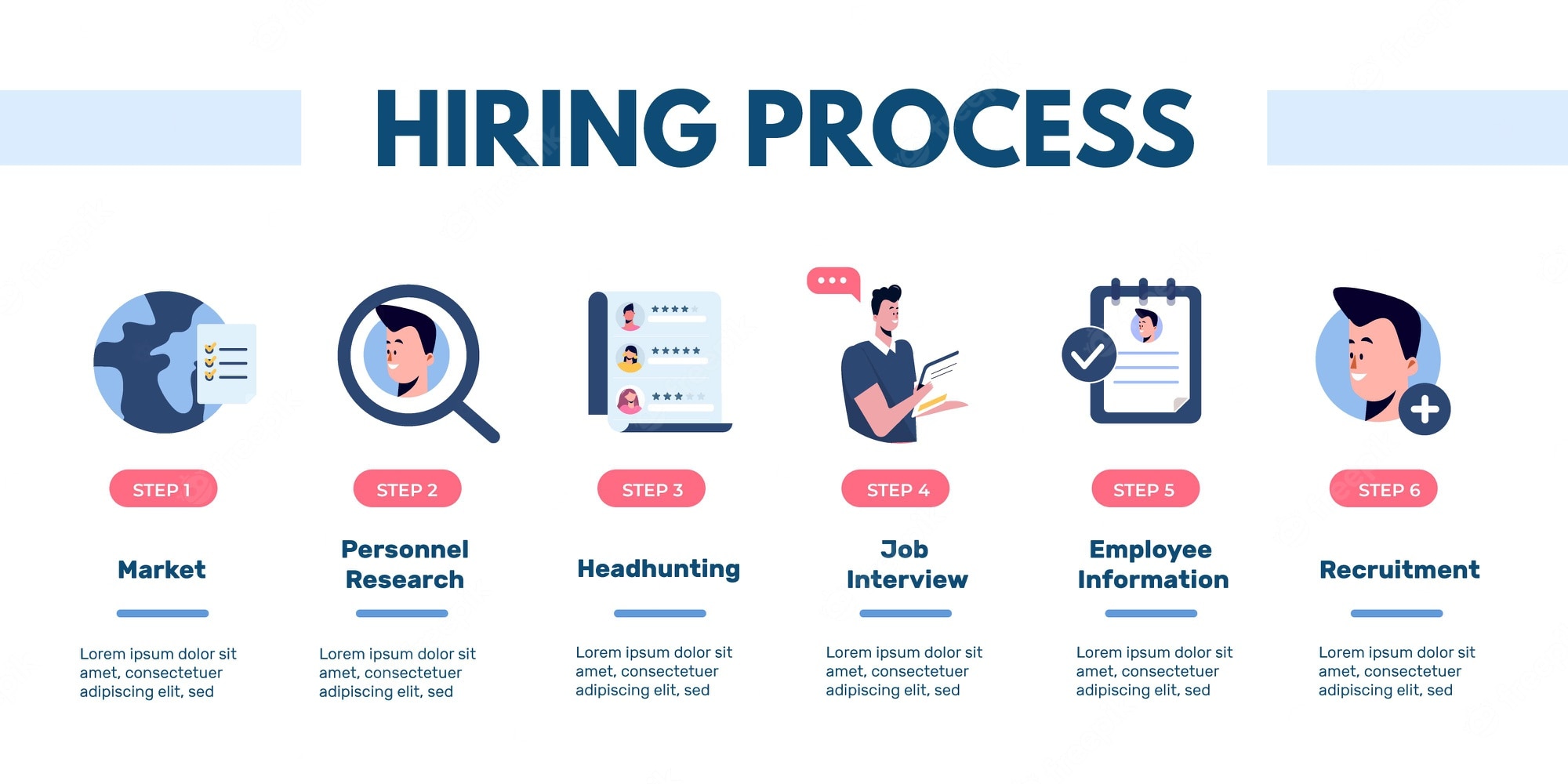

3 Steps to Open an Online Business Checking Account

For the best chance of opening a free business checking account, follow these three steps.

In-Person eKYC : Visit a branch to verify your identity through an eKYC process, and then open your account online. You’ll use the account number to link your account to your online banking login information.

Online eKYC : Complete an online-only eKYC process that involves uploading personal documents to the bank’s website. You’ll then use the account number to link your account to your online banking login information.

Online Account Opening + In-Person eKYC : Open your account online, then visit a branch to verify your identity through an eKYC process. Once your account has been verified, you can link your account to your online banking login information.

What’s Required?

The specific requirements for each bank’s free business checking account will vary. However, most banks require basic information such as your name and tax ID number. Some banks also require you to enter your projected monthly account balance. This information will help banks determine the appropriate debit card type to issue you, as this can vary based on the average funds in the account.

Final Words: Is Opening a Free Business Checking Account Worth It?

Opening a free business checking account can save you time and money. And because these accounts are available online, you can open them from your computer or mobile device. If you’ve been paying for a business checking account, the amount saved might be enough to justify the time spent opening one of these accounts.

If you’ve been managing your finances without an account, the benefits of a free checking account might be enough to spur you into action. And once you’ve opened a business checking account, there are steps you can take to avoid overdraft.